-

Arch Resources has announced its strategy to move away from the Powder River Basin in its third quarter earnings report. The second largest national coal…

-

A federal judge has ruled against a proposed joint venture between the two largest coal producers in the nation. District Judge Sarah Pitlyk found that…

-

The two largest American coal producers have pushed back against the Federal Trade Commission's claim that a proposed merger would cause "anticompetitive…

-

On May 15, Arch Coal officially changed its name to Arch Resources, Inc, in conjunction with the launch of its new website. The two moves are part of a…

-

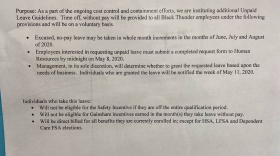

As other Powder River Basin (PRB) coal companies lay off miners by the hundred, Arch Coal, operator of the Coal Creek and Black Thunder mines, is asking…

-

The recently bankrupt coal giant Cloud Peak Energy is struggling to find short-term cash. The company initially got a loan for up to $35 million to stay…

-

Two of the largest coal producers are combining forces to better compete with natural gas and renewable energy. Peabody and Arch Coal are consolidating…

-

Arch Coal and Peabody Energy recently announced it would consolidate seven of their mines; five of which are located in the Powder River Basin. If the…

-

The recently bankrupt coal giant Cloud Peak is planning to sell off its assets next month. But a new deal between Arch Coal and Peabody Energy could throw…

-

Two of the largest coal producers are combining forces to better compete with natural gas and renewable energy. Peabody Energy and Arch Coal are…

Play Live Radio

Next Up:

0:00

0:00

Available On Air Stations